Introduction

Welcome to the financial review of April 2024. In this review, I will create on overview of my entire financial situation. I will assess multiple key factors of my net worth and visualize my current assets. This review functions as a way to reflect upon my foundation of money and is a requisite for my future wealth. I will not talk about my income, spendings and investments here. It is merely an analysis of wealth status. If you are more interested in checking out all my spendings, income and investments, check out my other blog posts. Without further ado, let’s get started!

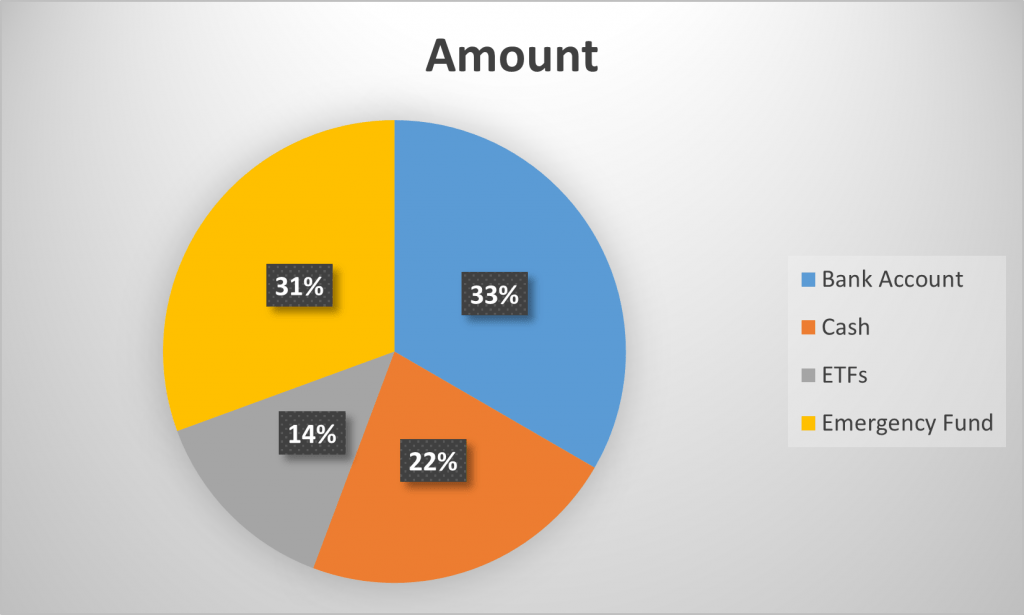

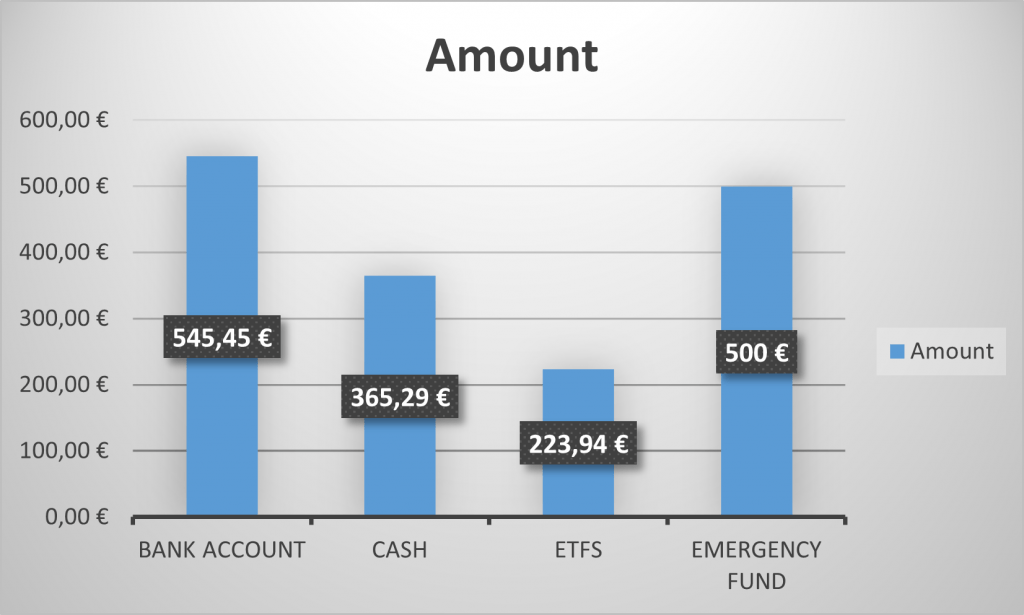

Asset breakdown

This will be quick and dirty. This is only my second month of building long-term assets. In fact, I’ve invested and saved money for quite a while but ended up losing everything, spending everything and not getting to keep it. With this blog and my future ahead, this will stop.

Firstly I have two positions which are virtually untouchable for me. They are my emergency fund and my current investments. They function as my puffer, my pillow. In famine, they are supposed to keep me warm and fed. Secondly I have money that is accessible at any given moment. It covers my daily spendings and my debt repayments.

As the chart above shows my current assets have a worth of 1,634.68€; 910.74€ which is usable and 723,94€ is bound in my emergency fund and retirement fund. I’m focusing on increasing my emergency and retirement fund amounts while paying off my debts as quickly as possible.

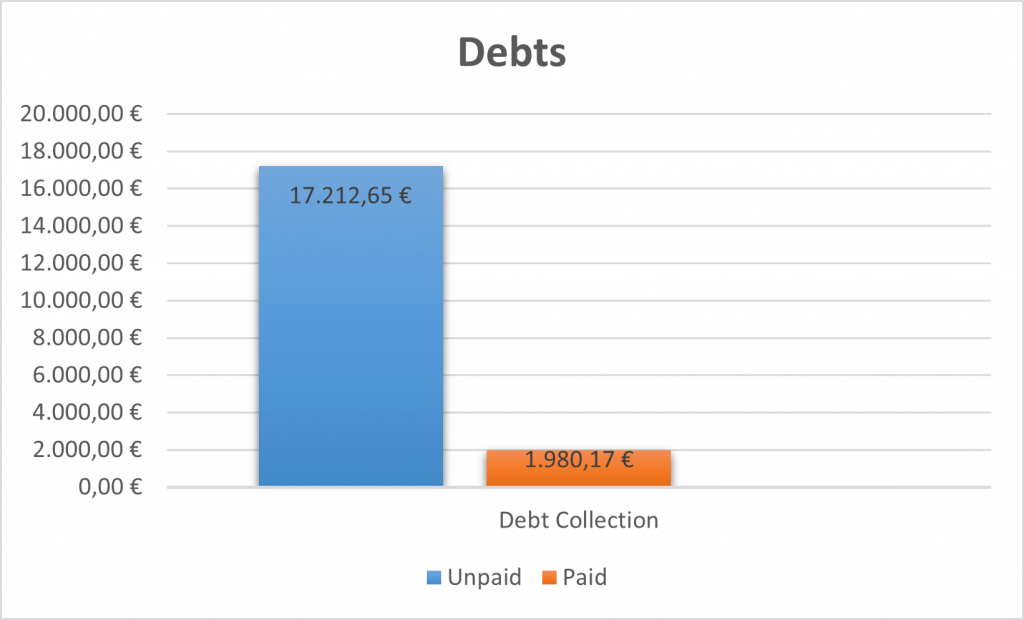

Debt breakdown

The debt breakdown of April 2024 might be frustrating to look at. My current debt is fairly large and will take a while to pay off. With a baffling 17,212.15€ and an interest rate of 8,12%, it is clear that this MUST be my first priority. Getting rid and lowering the debt is the primary goal of budgeting so drastically.

The second position is unclear yet. In 2023, I had two full months and some extra days in which I was neither employed, nor received any citizen benefits. Because it is mandatory to have a health insurance in Germany, I was simply insured. After a few months they sent me letters with a bill of over 5,000€… This is clearly not correct and they mistakenly assumed that I was self-employed with a maxed out income. This is not true and should be corrected soon, my estimation is the sum you can see. It may be a little different tho.

How I will pay my debt

I need to pay back my debt but my income is not incredibly high. The interest rate on the other hand is quite handy for the debt collection. I am going to try to message the original creditor and try get a repayment plan. If the interest rate could be lower or even removed, this would save me a lot of money. I created a chart in which you can see how much money I would have to pay back per month to be debt free in x amount of months, the total money paid back from this point and the extra money that would be lost with a lower payback rate.

| Payment/month | Months | Paid Back | Interest |

| 400€ | 52 | 20,412.20€ | 3,200.05€ |

| 500€ | 40 | 19,661.71€ | 2,449.56€ |

| 700€ | 27 | 18,889.44€ | 1,677.29€ |

| 1,000€ | 19 | 18,362.44€ | 1,150.29€ |

| 1,200€ | 16 | 18,167.42€ | 955.27€ |

| 1,500€ | 12 | 17,977.74€ | 765.59€ |

The chart I created clearly indicates how important it is to either lower the interest rate or pay back the amount in the quickest time possible. I am interested in both and hope to be debt free as soon as possible. In the upcoming months, as soon as I have a full overview of my spendings and incomes, I will create a plan. The plan is outlined to lower my costs and increase my debt repayment, all at the same time of increasing my current investments. I am looking into a positive direction.

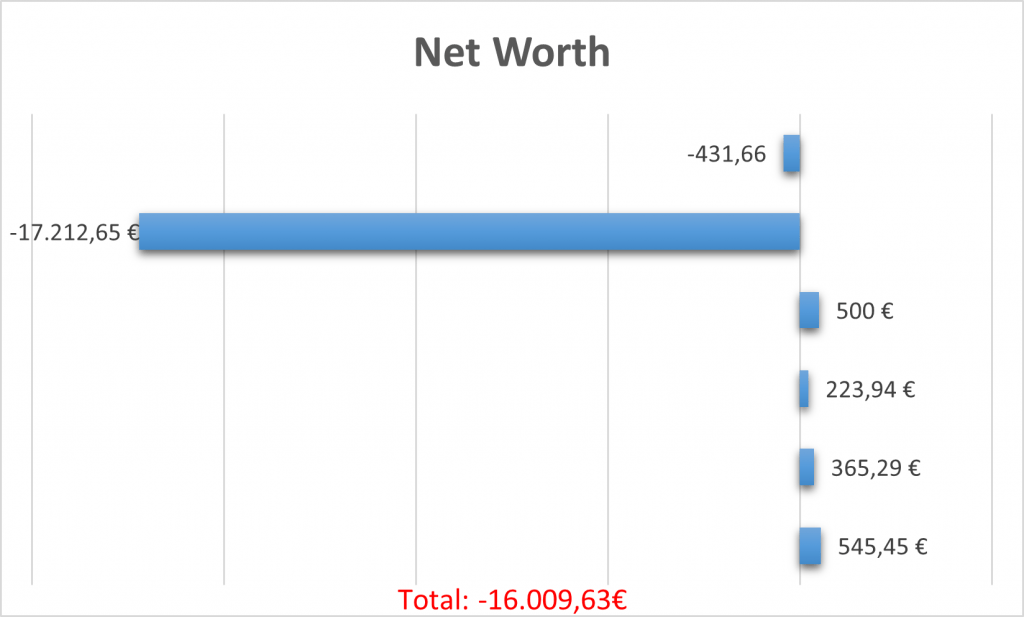

Net worth

To calculate your net worth, you need to put all your debts and your assets together. In my case this is rather simple and reveals a stunting number. My current net worth is -16,009.63€. This is BAD. But it does not have to stay bad. Often your net worth reflects your wealth in your mind. I can say that this is true for me. I wasn’t conscious enough about money and got what I deserved.

Final thoughts

My net worth review shows a lot of negative numbers and uncertainties. It is a signature of bad money habits and careless living. But the amazing part is, that this is only a picture of my past-self. I am able to make better decisions now, I learned a lot. A proper plan will help me to repay my deeds. Within the next 12 months, I hope to see my net worth slide into the positive numbers.